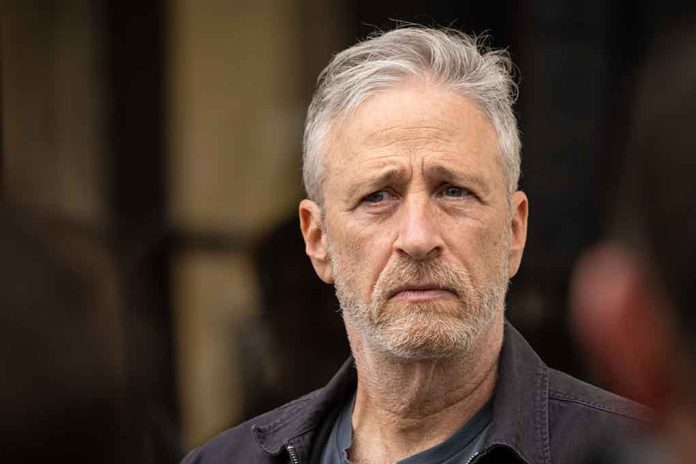

(NewsSpace.com) – Former President Donald Trump was found guilty of committing business fraud, inflating his property values in order to help him obtain loans. He has been ordered to pay a $454 million fine, a ruling that he is currently appealing. While that case has been prominently featured in the media, it’s also being tied to comedian Jon Stewart, who was recently accused of being a hypocrite.

The Accusations

Stewart, who hosts “The Daily Show” on Comedy Central, sold his Tribeca penthouse for $17.5 million. The New York Post suggested that value was more than 800% higher than the estimated market value, which led social media users to call Stewart, who has made a habit of mocking Trump’s legal woes, out for hypocrisy. They say he is doing the same thing he is lambasting the former president for—inflating his property value. An assessor had valued the property at $847,174.

Stewart Responds

In a post on X, formerly Twitter, the comedian was quick to refute that his actions were anything like Trump’s. Of course, he did it in a typical Jon Stewart way, by lobbing sarcasm and saying he just needed to do a few more things Trump was accused of and people would “revere” him.

OMG!! I've been caught doing something not remotely similar to Trump! I guess all I need to do now is start a fraud college, steal classified docs, bankrupt casinos, pay hush money, grab pussies, discriminate in housing, cheat at golf and foment insurrection and you'll revere me!

— Jon Stewart (@jonstewart) March 27, 2024

Experts agree that Stewart did nothing wrong. University of Michigan assistant professor of business law Will Thomas said the comparison “falls somewhere between non sequitur and nonsensical.” He pointed out that “discrepancies between tax-assessment value and market value doesn’t figure into the analysis of wrongdoing,” except in the case of when someone profits from illegal activities and has to pay a disgorgement penalty. Disgorgement penalties require those who committed the wrongful acts to give up the profits they gained as a result.

New York state applies tax rates to the estimated value of a property, not what it sells for. The comedian can sell a property for whatever a buyer is willing to pay for it, there’s nothing illegal about that. However, Stewart would be on the hook for profits made from the sale, known as capital gains tax, but that’s an entirely different matter.

Economist and University of San Diego emeritus professor Norm Miller said that in this case, “The assessed value is being taken as an indication of market value, which it should not.” Trump, he says, “provided misleading values on the upside for financing and on the downside for property tax purposes,” highlighting the main difference between the two situations.

Copyright 2024, NewsSpace.com